Do you need to create a payment request form? Although calling customers and telling them to pay past-due bills is frustrating, it is something that company owners and administrators must do from time to time. Pay request forms (PRFs) usage is to make payments to entities under some situations. In some cases, companies use this to initiate awards, such as payments to scholarship recipients and many more. Also, it releases payments to entities for which an invoice is not usually necessary, such as grant redemption or delivery.

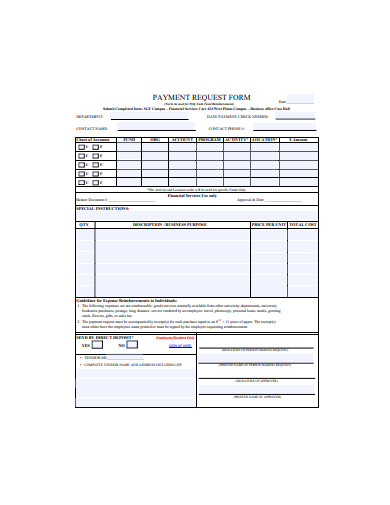

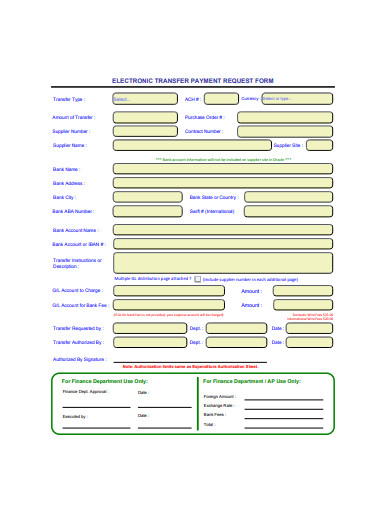

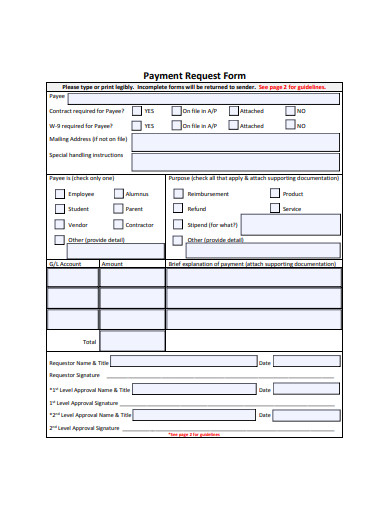

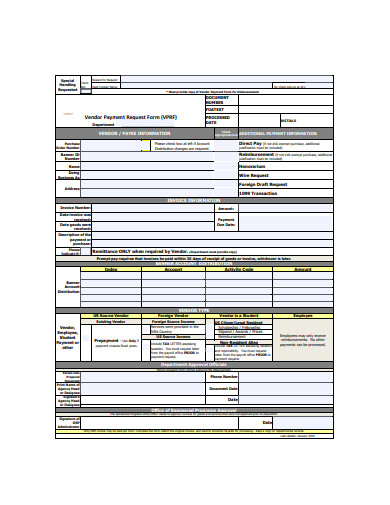

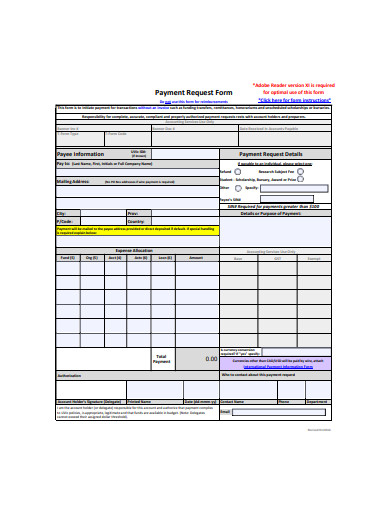

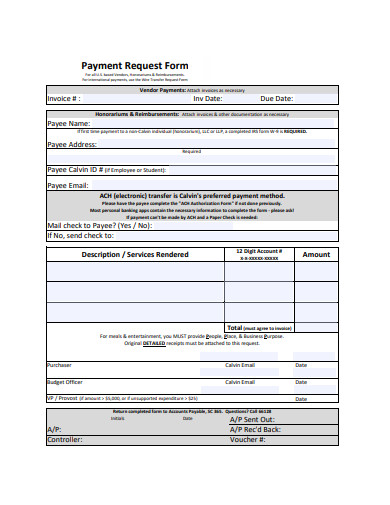

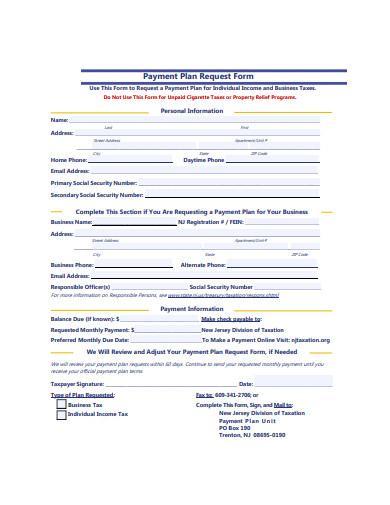

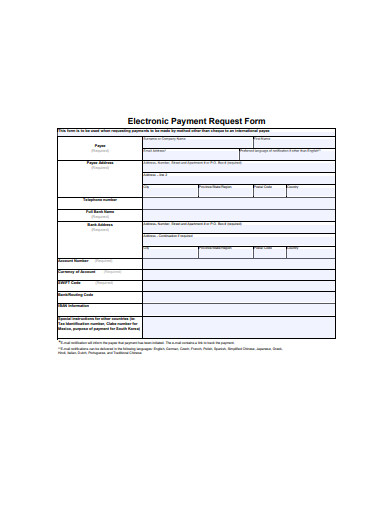

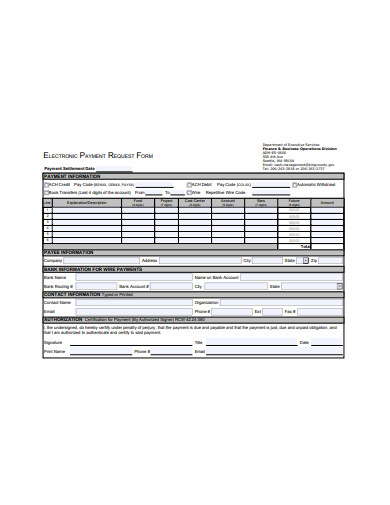

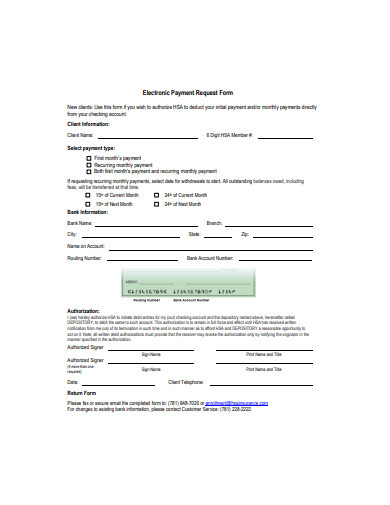

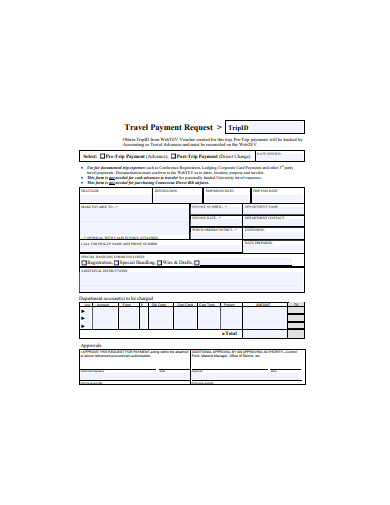

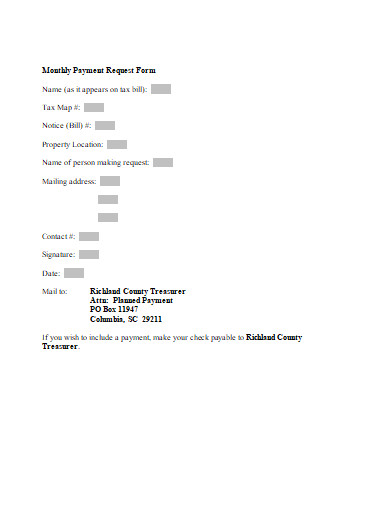

Here are some templates and tips that you can use in creating a payment request form:

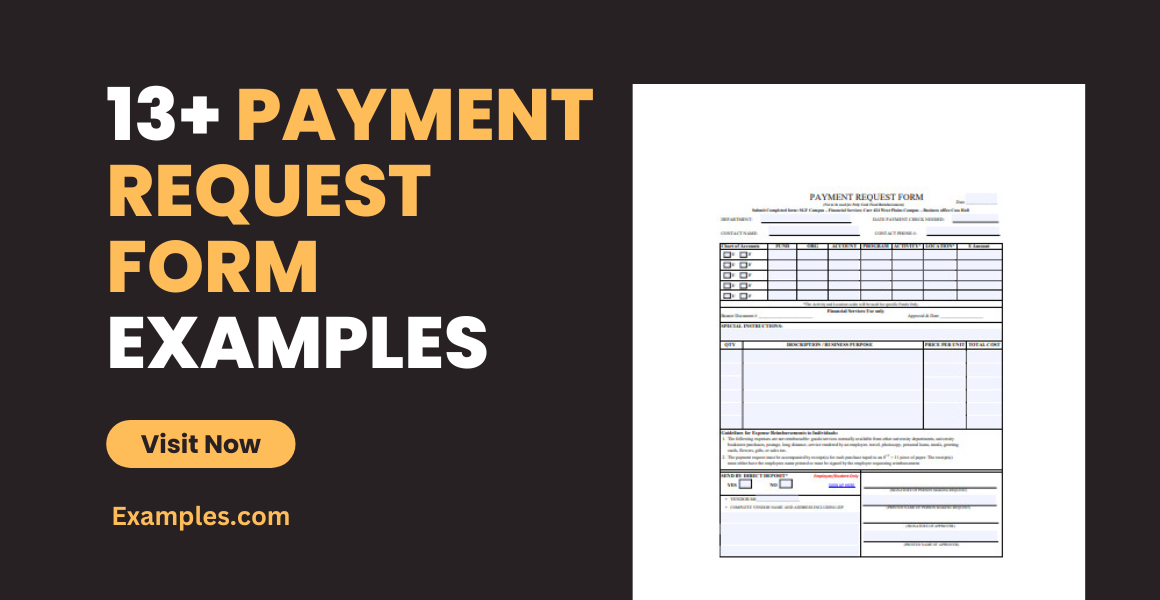

A payment request is an unusual request by a department for the organization to approve payment for products or services. When an invoice isn’t accessible, sometimes, it is used for transactions. A payment request is a connection between a seller and a buyer. Once a customer completes the purchase, he or she is on a safe checkout tab. The customer enters their credit card information at the register and pays for the service or product they want.

Although you can change the details attached in your template to fit your needs, it’s also necessary to use a professional tone and format. Many professionals lack knowledge about this. That’s why you should take note of the following to create an accurate payment request:

It’s necessary to articulate the point as accurately as possible. This is especially true when keeping a constructive, respectful tone while delivering a letter to a client or customer request payment. Sending a first or second submission that is so derogatory that the customer feels attacked is not a good idea. If the tone is too rough, the customer will conclude that there is no point in continuing to work with your company. When this happens, the customer will decide not to pay the bill. It’s because he or she may not be serious about maintaining the relationship.

If you’re mailing an invoice order envelope, use company letterhead and a regular business letter format. It might be acceptable to send the letter by email, depending on the company’s communications procedures. If this is the case, it is preferable to have the letter in the email address body rather than the attachment. An email message does not include a letterhead design, but it should be closed with the official company email signature.

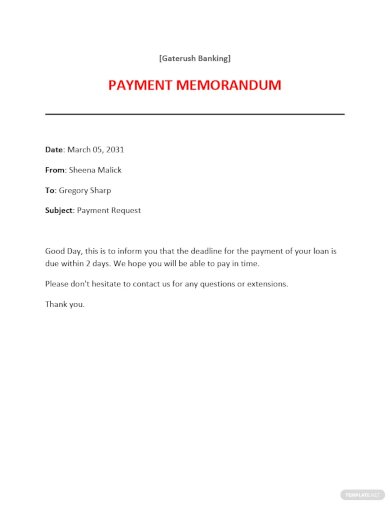

When you did not obtain the payment as negotiated, you must escalate the transaction to the next step in your company’s overdue account control process. Also, when you did not charge the bill for a long time, the language of subsequent collections letters would need to be more specific. Although there are certain situations in which final collections action is necessary, it is not applicable until you have consumed any other possibilities for settling the late payment amicably.

Try requesting a follow-up phone call if you file a bill request letter for a past account and do not hear back from the receiver within 30 days. Maintaining an optimistic note, as with the letter, is appropriate. Attempt to communicate with the person in charge of paying the bill personally to validate the message. Offer to process credit card payments on the phone or online if you may communicate with the responsible person. If not, inquire as to whether you should receive reimbursement. Create a notice of the date and send a late payment letter as soon as possible.

Double-check the invoice for any inconsistencies or miscommunications until requesting reimbursement. Send a polite note to the customer informing them that the bill is past due and reminding them to double-check that they received the initial invoice with no issue.

Late payments are addressed quickly by delivering a friendly email to the customer informing them that their bill is past due. If you do not get a response, writing a letter will help to formalize the situation. So, be sure all of your correspondence addresses are current, and keep a copy of everything you send and receive.

Yes, you have the moral right to sue people for the money you lend them. In several cases, a verbal arrangement is legally binding. You’ll need to be able to demonstrate the terms of the deal, something you should be able to do with your bank statements and text messages.

One of the most important goals of the company’s financial reporting is to ensure that consumers and customers receive timely invoices for the goods and services they buy. That’s why you should take note of the information and templates above. They will help you do your task quicker and more efficiently.