Searching for a wholesale lender with competitive rates and variety of specialized loan products? Get connected with REMN Wholesale through the AIME Member Portal today!

The Nationwide Mortgage Licensing System and Registry (NMLS) is a web-based platform for regulatory agencies to administer initial license applications and ongoing compliance requirements. This platform is used by participating agencies to process the applications of companies and individuals looking to apply, renew, surrender licenses for various industries.

NMLS is mostly used by Mortgage Lenders, Mortgage Loan Originators, Money Transmitters, and Money Services. Depending on the state in which you live and your business is operating within, you should be aware of the regulations your specific state requires. Throughout the process of starting your own brokerage, this step can be lengthy, but highly important to complete.

Follow along as we guide you through the process of understanding the NMLS requirements for starting your mortgage brokerage.

As a part of the NMLS requirements, each new business owner or mortgage loan originator (MLO) is required to complete these beginning steps. You will need a criminal background check, need to be fingerprinted, and will have a review of your credit history. This is relatively simple if you have the documentation and items you will need to complete this section.

Criminal Background Check & Fingerprinting

Every mortgage loan originator is required to have a criminal background check (CBC) through NMLS whether you’re state-licensed or federally registered. If NMLS does not have existing prints on file for the background check, individuals must schedule their fingerprinting appointment through an NMLS vendor within 180 days of completing their application.

If your fingerprints are not submitted within that time period, the background check window will expire in which you’ll have to authorize and re-pay for a new one. Although, NMLS can use fingerprints that are on file for up to three years old therefore you wouldn’t have to re-do the fingerprints in order to request a new CBC application.

Once you’ve submitted your application, NMLS will then process and deliver your results to state agencies who license and review new applications for licensure. These state agencies will individually evaluate your CBC results to determine eligibility for licensure, as required by the SAFE Act (Secure and Fair Enforcement for Mortgage Licensing). Each state agency has its own criteria for licensing.

Credit Report Check

This is another step within the professional standards on NMLS that each MLO is required to complete. First, individuals must complete the Identity Verification Process (IVP) beforehand. Upon submission of your credit information, NMLS will process and deliver the results regarding your credit report to state agencies to determine your financial stability. Again, each state has its own requirements for this process.

If necessary, regulators will communicate with you by placing a license item on the record in NMLS or through the various other ways outside of the platform. State regulators are prohibited from disclosing any information regarding your credit report with any entity other than the name on your documentation. If you’re applying as an individual entity, a credit report is not typically required unless requested by a regulator.

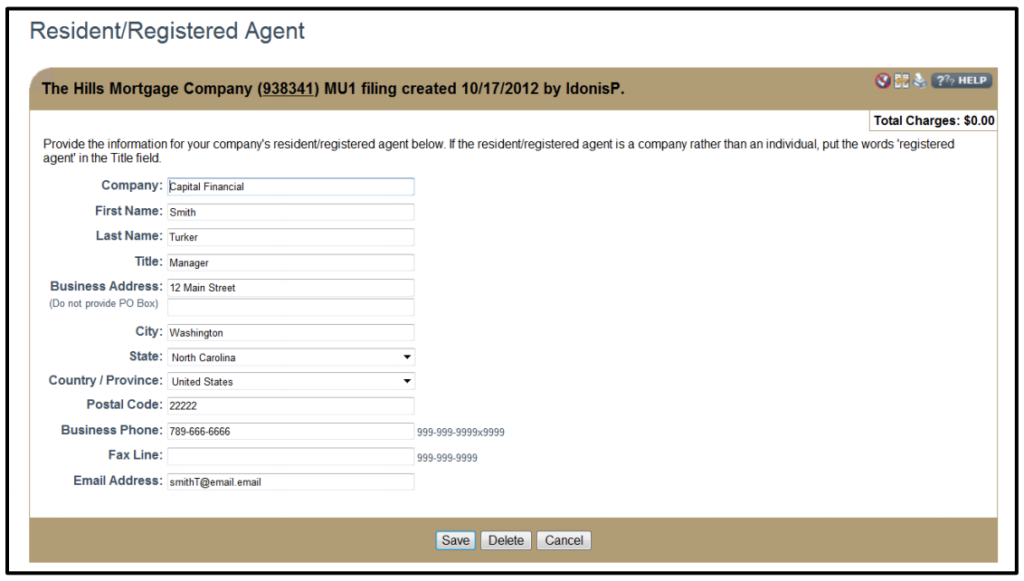

As part of the NMLS application process, you will need to identify a resident/registered agent for your business. This is the entity that will receive service of legal process on behalf of you and your license. A resident/registered agent must be identified in each state in which license/registration is held and the business address must also be within that state.

If a state does not require this aspect of the application process, it’s best to consult the state licensing requirements to determine how you should complete this particular section. Typically, states will accept the owner or officer of the company to be identified as the resident/registered agent.

As soon as you start accepting and spending money as a business, you should open a business bank account. Common business accounts include a checking account, savings account, credit card account, and a merchant services account. Merchant services accounts will allow you to accept credit and debit payments through your business.

As stated by the Small Businesses Association, most banks can offer perks on business accounts that might not come with standard bank accounts.

As you can see, the benefits of creating a business banking account are endless. This is a great way to pay for processing fees associated with the various requirements needed within NMLS, especially for new businesses. To open a business bank account you will need your EIN number, formation documents, ownership agreements, and business license.

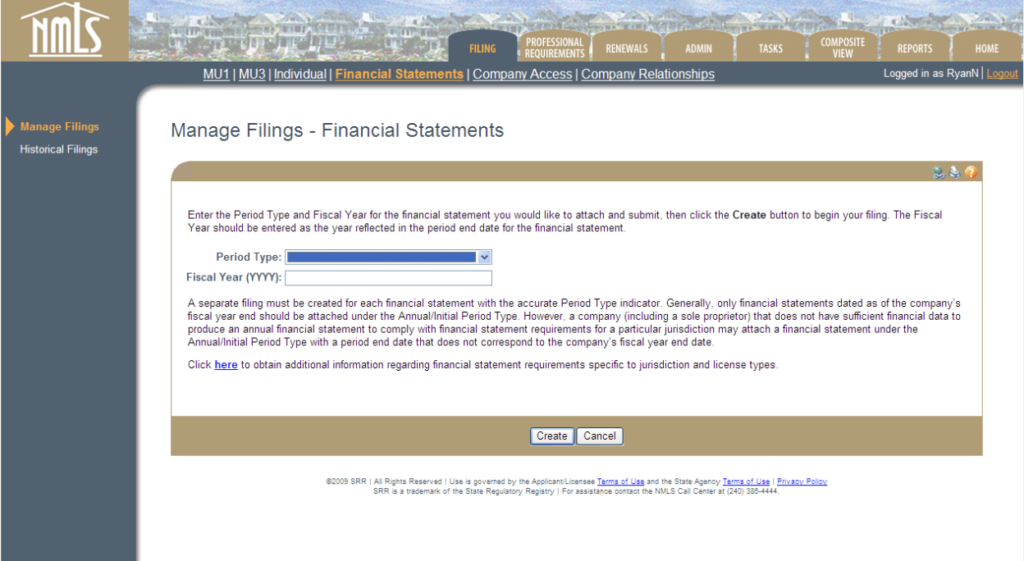

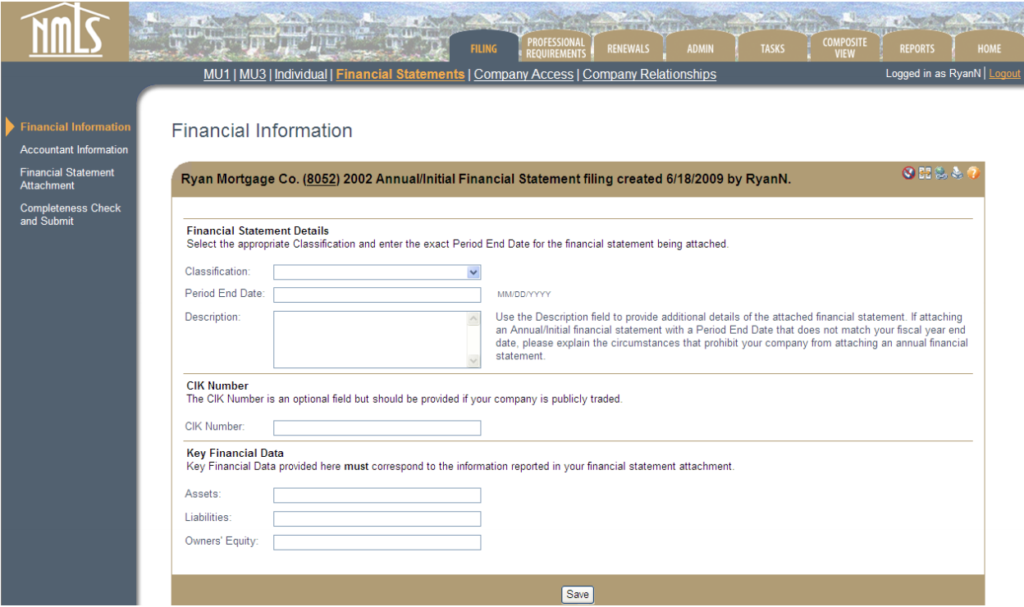

A company’s financial statements are quantified reports of its performance for a specific period, usually a year, but can also be quarterly. These are normally made up of and determined by balance sheets, income reports, and cash flow statements. Ultimately, the numbers within this statement are used to tell investors, authorities, and the company itself whether they’re growing or shrinking in the business.

NMLS enables company account administrators and designated company users to file the financial statements on behalf of the business. Most states require companies to file this information prior to submitting a license application, on an annual basis or at other designated times throughout the year. Each state does vary based on license type and jurisdiction, therefore it is recommended to research your state’s requirements.

Regulators often put policies in place requiring licensees to file an annual financial statement in which they must do so within their fiscal year-end. These reports should be filed no later than 90 days after that time period has ended. NMLS does allow licensees to submit quarterly updates and semi-annual reports that may be required by regulators as well.

If you’re submitting a financial statement that does not match your current fiscal year, you must provide an explanation of your circumstance that prohibits your company from attaching an annual financial statement.

Only up-to-date documents regarding these financial statements are accepted within NMLS. Other documents regarding previous years can be submitted under the proper period type. It is important to note that in some cases, regulators may require consolidated schedules about the licensee itself.

Licensees are required to submit a financial statement and meet their net worth requirements that satisfy the highest, or most stringent, standard among all NMLS jurisdictions in which they are applying for licensure or already licensed within. You must submit these statements in single PDF formats into NMLS.

Audit Statements

As a part of the SAFE Act (Secure and Fair Enforcement for Mortgage Licensing), yearly audits through NMLS may be required. It should be conducted by independent auditors testing for compliance through their personnel or outside parties.

Requirements to consider:

Need help staying well-versed on industry regulations? With Strategic Compliance Partners, they’ll ensure your company’s compliance management is up-to-date.

Capital refers to the amount of funds your business will need to achieve its goals and cover any start-up expenses. Each of these costs has the potential to vary depending on the state you’re operating within and the size of your business.

These funds will be what you use to ultimately pay salaries if you choose to hire employees, any future expenses, unexpected fees, and anything else that comes along with a new business. Every business will need capital in order to start or finance it during the formative years with reasonable estimations considered.

A surety bond is required by NMLS. A surety bond is a specialty insurance product that provides minimal protection. Depending on your state you could need a bond ranging from $25,000 to $75,000. If a client were to experience a loss due to your business, the bond pays the client and the bond company reclaims the payment from you.

A Surety Bond is a legally binding form that guarantees the person or business that purchases the bond will act in accordance with certain laws and contract terms. These bonds are supposed to help new businesses to win contracts by guaranteeing the work or service they promised their clients will be executed properly.

Read more about surety bonds in your state.

In any type of business, mistakes can happen or issues can arise. Sometimes these mistakes and issues can cost anywhere from hundreds to thousands of dollars to resolve between legal fees and customer-related problems. Investing in errors and omissions insurance, also known as professional liability insurance, to fix these issues will save your business in the long run.

Overall, errors and omissions insurance is a solution that offers customized coverage to protect you in the event of a lawsuit alleging negligence in providing or failure to provide your professional services. As a business owner, it’s important to have because it can protect you from legal fees, defense costs, and recovery from a financial loss especially when you’re dealing with customers or clients.

E&O insurance helps protect specifically against attorney fees, which can range anywhere from $100 to $400 per hour. Also, in certain cases (such as anything regarding liability) litigation can last up to several months.

Legal costs can range anywhere from $3,000 to $150,000 due to having to pay for an attorney, court fees, and various other expenses involved with lawsuits. Also, this insurance can cover any administrative costs regarding written testimonials, medical records, business receipts, invoices, or employment records.

Errors and omissions insurance helps to protect and support you throughout the settlements or judgments that may be awarded to the person suing you. This can cost anywhere from thousands to even millions of dollars and without this coverage, it can easily put your company out of business.

A certificate of good standing, also known as a certificate of existence or a certificate of status, is a legal document that says your company is registered with your state. This document proves you’re authorized to do business there and that you follow all state requirements, like submitting documents and paying taxes on time. This certificate is signed by the Secretary of State and is usually good for anywhere from 30 days to six months depending on why it’s needed.

If you plan on growing and expanding your business, it’s important to have a certificate of good standing. It can be used for anything such as choosing to operate your business in other states, apply for a small business loan, purchase or sell real estate, or open a business checking account. In some cases, a certificate of good standing may be required as part of a loan application you’re sending to the lender.

A certificate of good standing should not be dated more than 60 days prior to the filing of your application through NMLS. In order to acquire this certificate, requirements and the process of requests do vary by state therefore it’s important to check in with your specific state.

As part of a new business, it is required to showcase your current position holders, directors, officers, and management by their name and title within NMLS. This is also the section where you must identify compliance reporting and your internal audit structure. Once you become a high functioning brokerage, you’ll need to continuously update this file when management personnel are adjusted.

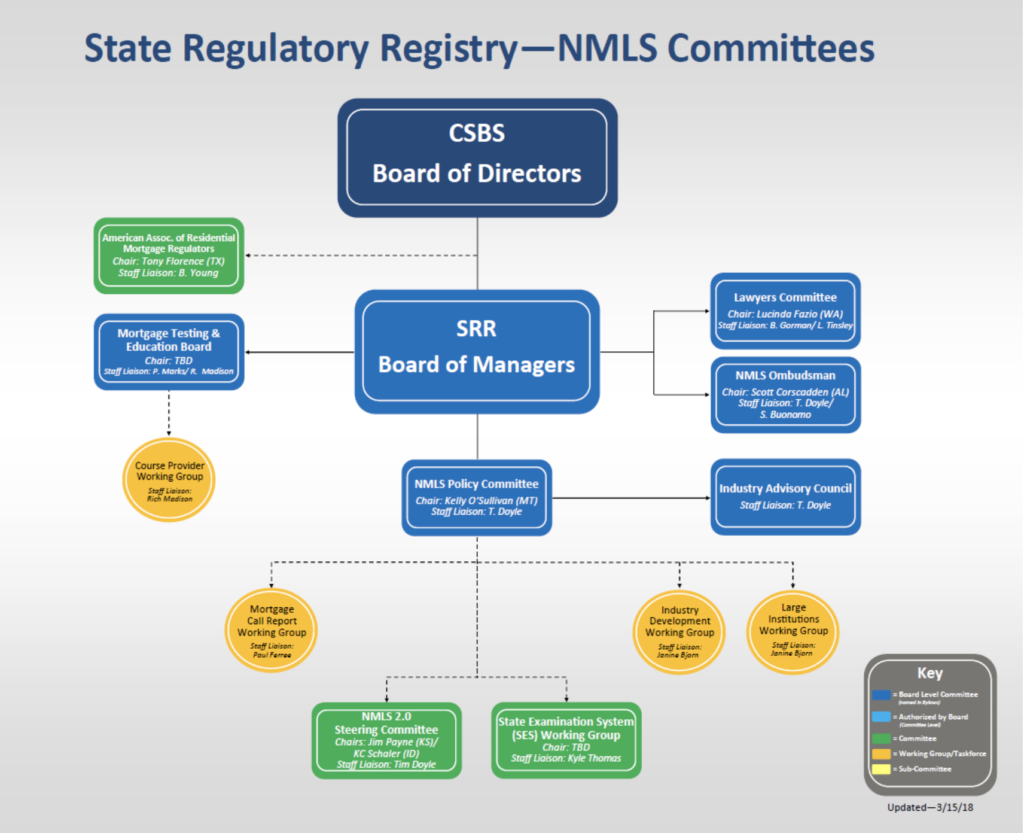

To do so, the existing document must be removed from the system and replaced with the new document in order to be successfully processed. Along with showcasing your management structure, creating an organizational chart for your business is required. This should explain the percentage of ownership any direct owners, indirect owners, subsidiaries, and authorized licensees have on your business.

Again, this is another document that must continuously be maintained within the system and updated as individuals are replaced. An example of the structure your organizational chart could follow can be this chart NMLS uses to showcase its committees.

For any new business owner, it’s important to structure how you want to run your business. There’s plenty of ideas for how to structure your business, but determining what is right for you is the most important. In some states, especially for brokerages, business owners are required to submit a business plan along with their application.

Utilizing a business plan to structure your business can help you ensure consistency, growth and save time when it comes to issues or problems that may arise later on. We’ve created a step-by-step business plan guide and a downloadable business plan template to help as you begin the process of starting your brokerage.

This blog article is sponsored by REMN, an approved AIME Lender Partner. REMN provides the knowledge, expertise, and complete support needed to get renovation and non-QM loans to the finish line. Not connected with REMN? AIME will make the introduction. Log into the AIME Portal today to get connected.